Why more parents plan to support adult children

Leza and Anthony Dieli are saving about $1,000 a month for their 7-year-old daughter, not for camp or college, but to help her once she is an adult. “I want her to feel like she has options,” Leza said. Their plan reflects a wider shift. A new strain of advice says it is reasonable to help grown children, and many parents are preparing for it. In a 2024 Pew Research Center survey, about 60% of parents with children ages 18 to 34 said they had helped financially in the previous year. Financial planners say parents see the need and, when they can, they step in. As adviser Patrick Huey put it, “Parents are more permissive now and more likely to provide, but I also think the need is greater.”

How many young adults are living at home, and what is the trend

Living at home has become common, though it varies by age and definition. Among adults ages 25 to 34, 18% lived in a parent’s home in 2023. The share rose steadily from 2000 to 2017, then dipped somewhat in recent years. Among those ages 18 to 24, 57% lived with a parent in 2023, up from 53% in 1993. A 2023 Harris poll found that about 45% of young adults ages 18 to 29 were living with their parents, making it the most common arrangement for that group since just after the Great Depression. Most young adults who live with parents say the arrangement helps their finances, though they are less positive about its impact on independence and social life. About 72% of those living with parents contribute financially to the household in some way.

How much help parents are providing

Support is not just the occasional check. A 2025 Savings.com survey of 1,001 parents found that half provide regular financial assistance to adult children, averaging $1,474 per month per child, a six percent increase over last year. The most common items covered are groceries or food for 83%, cell phones for 65%, and rent or mortgages for 63%. Parents also help with health insurance, cars, tuition, and even vacations. Working parents who support adult children say they contribute more than twice as much to their kids each month as to their own retirement funds, which adds stress. Seventy-nine percent of those supporting adult children worry about having enough for retirement.

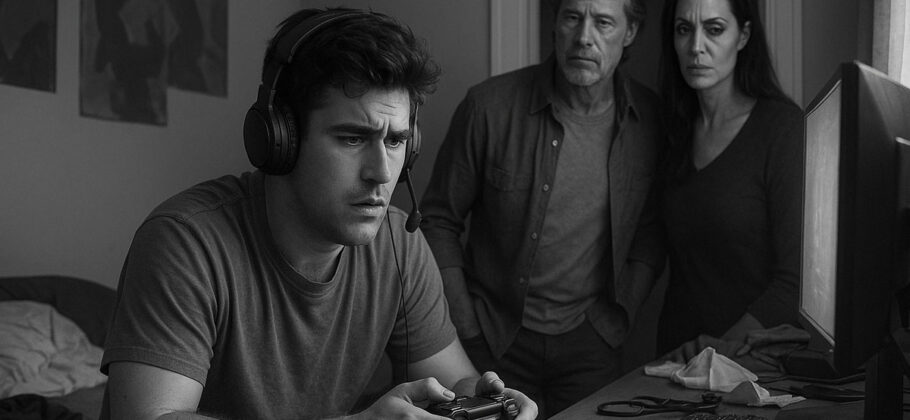

What “endless parenting” means

Writers and researchers describe a new phase of family life. “Endless parenting” captures the near-constant contact and ongoing financial and emotional involvement between parents and adult children. Decades ago, a weekly pay-phone call might have been the norm. Today, parents and young adults are in touch much more often. In Pew’s surveys, 73% of parents text a young adult child a few times a week, and 54% talk by phone that often. Many young adults turn to parents for advice on jobs, finances, and even health. Families are more tightly knit, and the old idea that parents should fade into the background after high school or college has softened.

Parents see their children’s outcomes as reflecting their own role. Seventy-one percent say their kids’ successes and failures reflect on their parenting. Relationships are close. Seventy-seven percent of parents say the relationship with their young adult children is excellent or very good. Mothers tend to be in more frequent contact and to be leaned on more for emotional support. At the same time, fewer than half of young adults say they are completely financially independent, but most believe they will get there.

Why younger adults are having a tough time

The cost picture helps explain the shift. Since 1980, inflation-adjusted earnings are up 18%, but housing costs have risen more than 400%, medical care nearly 700%, and tuition and child care more than tenfold. Parents see rents, debt, and entry-level job hurdles and decide to help. Financial adviser Robert Persichitte urges families to plan for it: “You either need to be comfortable with your kids struggling or you need to set aside some money now.” He helped the Dielis estimate that saving about $2,000 a month could eventually fund a $3,000 monthly allowance for life after college. Other families think of it as an early inheritance, giving help when it matters most.

Boundaries, conditions, and sacrifices

Support often comes with rules. In the 2025 Savings.com report, 77% of helping parents attach conditions, up from 71% last year. Common requirements include holding a job or actively seeking one, staying in school, contributing to household expenses, and following a budget. About 63% of supportive parents also provide housing, and the share of live-at-home children who contribute to costs rose from 39% to 51% in a year. The trade-offs are real. Nearly half of supporting parents said they have sacrificed their own financial security. Many are willing to live more frugally, pull from savings or retirement, postpone retirement, or even take on debt to keep children afloat. At the same time, almost 40% plan to cut off support within two years to encourage independence.

Parents and advisers voice both hope and caution. Leza Dieli wants her daughter to have choices that she did not have after graduating during a recession. Persichitte shares his own story of living rent-free with a grandmother, paying down debt, and buying a home before 30, and now counsels clients to plan ahead. A high-school teacher near Cleveland covers housing, car payments, and tuition for her 24-year-old daughter finishing community college, but has cut her own retirement contributions and vacations to manage the strain. She argues that parents should plan for help after age 18 because support needs do not end at high school graduation.

The conversation around money

Families are also talking more about finances. A U.S. Bank survey found parents are more likely than past generations to discuss investing and career choices with their children. Still, many Americans find these talks uncomfortable, and 37% of parents worry their kids will be financially dependent on them well into adulthood. More than half of Gen X parents share that concern. Financial advisors are helping families open up, with many clients saying advisers have guided them through difficult money conversations.

Parents are preparing to support their children later into life, and many are already doing so. More young adults live at home than in the past, and even those living independently often lean on parents for bills and advice. The drivers are clear. Costs have outpaced wages, and early-career paths are uneven. “Endless parenting” is the new normal for many families, but it works best with clear expectations, honest conversations, and realistic limits that protect parents’ long-term security while giving young adults a fair shot at stability.