For decades, earning six figures was considered the finish line. It meant stability, savings, and freedom from financial stress. Today, that assumption is breaking down fast. A growing number of Americans earning $100,000, $200,000, and even far more are still living paycheck to paycheck. Surveys now show that a six figure income is no longer a guarantee of comfort. For many households, it has become a fragile balancing act where one unexpected expense can trigger real financial trouble.

Financial planners and economists are seeing the same pattern across income levels. High earners are not poor, but many are stuck in what feels like survival mode. Rising costs, lifestyle pressure, debt, and lack of planning have turned high income into high stress.

The Scale of the Paycheck to Paycheck Problem

Long running national surveys show that roughly one in four Americans lives paycheck to paycheck. More recent surveys suggest the problem is far worse. A USA Today survey found nearly 60 percent of Americans have little to no savings or financial cushion. More than half of people earning six figures report living paycheck to paycheck.

A Harris Poll released in November found that one in three six figure earners described themselves as financially distressed. Two in three said six figure pay is no longer a sign of wealth. Three quarters said they had used a credit card because they ran out of cash. More than half said they would need to double their income to feel financially secure.

Goldman Sachs data reinforces this trend. A quarter of workers earning more than $100,000 said they live paycheck to paycheck. That number rises to more than 40 percent for people earning between $300,000 and $500,000, and remains high even above that level.

These numbers reveal a national savings crisis that now reaches well into the upper income brackets.

Why Saving Has Become So Hard

Years of inflation have steadily eroded purchasing power. Consumer prices are at least 24 percent higher than they were at the start of 2020. Even though inflation has slowed, households are still absorbing permanently higher prices for essentials.

Economists estimate that a worker would need to earn about $170,000 in 2025 to match the purchasing power of a $100,000 salary in 2005. This silent devaluation has caught many households off guard.

Where you live also matters. In 25 of the 100 largest metropolitan areas, average monthly spending on basic expenses exceeds the monthly income of a family of three earning $100,000. High earners tend to be concentrated in the most expensive cities, where housing, taxes, insurance, and daily costs are far higher than the national average.

Relocating is often not a realistic option. Careers are anchored to expensive regions, and moving to cheaper areas often means lower pay, which keeps households stuck in the same cycle.

Lifestyle Inflation and the Spending Trap

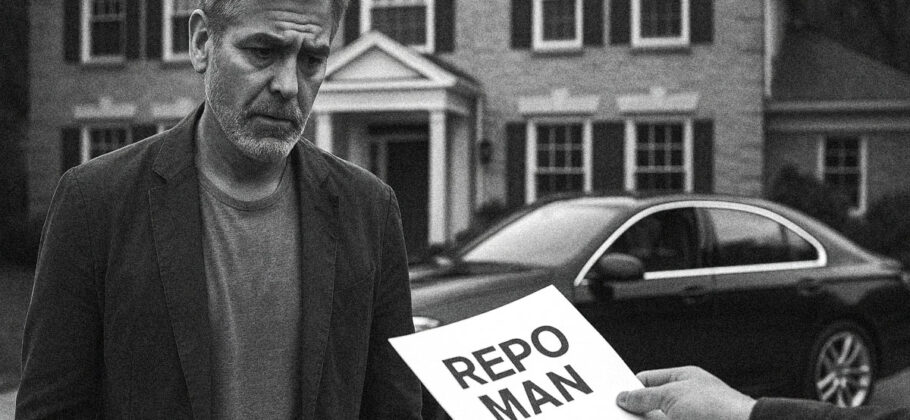

Financial planners describe a pattern they call lifestyle looping or lifestyle creep. As income rises, spending rises with it. Bigger homes, newer cars, private schools, frequent travel, dining out, and subscription services quietly expand monthly obligations.

Social pressure plays a major role. Social media creates constant exposure to other people’s highlight reels. Vacations, luxury purchases, and status symbols feel normal, even expected. Very few people share their debt or lack of savings, which makes overspending seem harmless.

Many high earners admit they have no clear spending plan. They cannot easily explain where their money goes each month. Without tracking or budgeting, nearly all income gets spent.

Easy credit worsens the problem. High earners qualify for larger credit limits, buy now pay later programs, and financing options that delay the pain of spending. Over time, invisible debt builds up until cash flow collapses.

The Big Three Financial Decisions That Break Budgets

Experts consistently point to three choices that cause the most damage for high earners.

Housing is often the largest problem. Buying too much house, or multiple homes, locks families into massive fixed expenses that grow over time through taxes, insurance, maintenance, and upgrades.

Vehicles come next. Expensive cars financed or leased at high monthly payments drain cash for something guaranteed to lose value.

Education costs are the third pressure point. Between private K through 12 tuition and college, families can easily spend hundreds of thousands or even more than a million dollars. These decisions are often driven by social expectations rather than long term planning.

Any one of these choices can strain a budget. Together, they can sink it.

High Income Does Not Mean High Financial Literacy

One of the most overlooked issues is pride. Many high earners are embarrassed to ask for financial help. They assume that earning a large income means they should automatically know how to manage money.

But financial planning requires skills in budgeting, cash flow analysis, insurance, taxes, and long term strategy. Income alone does not provide those skills.

A major CFP Board survey found that households with a written financial plan were more than twice as likely to report financial stability, regardless of income. Planning creates clarity. Clarity leads to discipline. Discipline builds wealth.

Without a plan, even very high incomes drift toward zero.

A Confusing Economic Picture

The broader economy tells a mixed story. Consumer confidence is low, yet spending remains strong. High income households now drive nearly half of all consumer spending, the highest share in decades. In aggregate, wealthy households appear to be doing well.

But individual surveys reveal something different. Many high earners feel stretched, anxious, and dependent on every paycheck. Some report cutting back on medical care, selling personal items, or skipping meals.

Experts say consumers often behave differently than they feel. Spending continues because obligations are fixed, not because people feel secure.

Goldman Sachs projects that by 2033, more than half of U.S. workers will live paycheck to paycheck. Elevated housing costs, health care expenses, childcare, and debt burdens continue to rise faster than savings.

The six figure paycheck has lost its role as a safety net. It no longer guarantees security, comfort, or peace of mind.

Experts agree that the solution is not earning more, but keeping more. Tracking spending, automating savings, resisting lifestyle creep, and making deliberate choices about housing, transportation, and education are critical.

The math is simple but unforgiving. Spend less than you make and invest the difference. Ignore that rule, and even the highest income can disappear.

FAM Editor: It is a combination of real estate prices, insurance pricing for health, home and car, and the propaganda we are constantly bombarded encouraging us to borrow to spend above our means. Many things for Trump fix…

In today’s America, six figures can mean success, or it can mean survival. The difference is not income. It is control.