Jamie Dimon, the longtime head of JPMorgan Chase, has launched one of the most ambitious national security investment plans ever attempted by a private company. His American Resiliency Pledge seeks to channel one point five trillion dollars into industries that he believes are essential for protecting the United States in an increasingly dangerous world. Dimon says the effort is not symbolic, but a serious commercial commitment meant to restore American strength and reduce dependence on foreign adversaries.

The plan has drawn major figures into his orbit. Jeff Bezos, Condoleezza Rice, Robert Gates, retired military commanders and leaders from top corporations have joined a new advisory council to guide Dimon’s strategy. Together, this group represents an unusual alliance of finance, politics, business and national security.

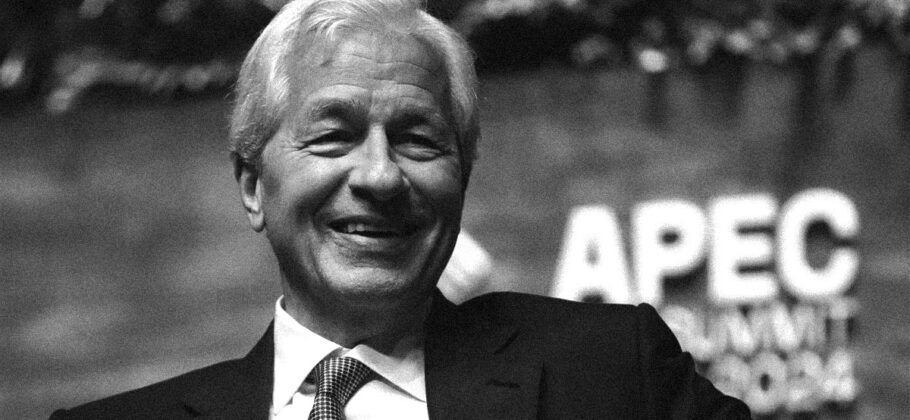

Jamie Dimon is one of the most influential financial leaders in the world. As the CEO of the largest bank in the United States, he has shaped debates around the economy, regulation and global stability for years. But since Russia’s invasion of Ukraine in 2022, he has become increasingly urgent about threats facing the United States.

Dimon told Fox host Maria Bartiromo that anyone who believed the world would remain peaceful must reconsider, saying, “If you had any illusion the world would be peaceful in our lives…it was shattered.” He has warned that democratic nations are falling behind on the production of basic goods needed for defense and survival. He has pointed out weaknesses in manufacturing of bombs, rare earths, medicines and even basic industrial materials. Dimon argues that the United States must act now, or risk becoming dangerously dependent on countries like China and Russia.

His motivation can be seen in another statement he made when announcing the pledge: “It has become painfully clear that the United States has allowed itself to become too reliant on unreliable sources of critical minerals, products and manufacturing.” For Dimon, the American Resiliency Pledge is meant to correct that vulnerability on a massive scale.

What the American Resiliency Pledge Will Do

The American Resiliency Pledge is a ten year, one point five trillion dollar commitment to invest in sectors that Dimon believes are essential to national strength. JPMorgan had already projected that it would support about one trillion dollars of business for its clients that involves defense, energy, supply chains and critical industries. The pledge adds another five hundred billion dollars in financing, plus ten billion dollars of JPMorgan’s own capital, which will be invested directly.

Dimon emphasizes that this effort is fully commercial. He said, “This is not philanthropy. This is one hundred percent commercial. We are going to take our resources of research bankers and investors, and we are going to scour the United States and maybe the world for new opportunities.” He believes the returns will be strong because governments, investors and companies are all moving toward rebuilding security and resiliency.

The focus areas include advanced manufacturing, artificial intelligence, defense systems, aerospace, energy independence, rare earth minerals and technologies such as drones and autonomous vehicles. Dimon has said that spending will grow rapidly in these areas, especially as the world confronts new geopolitical risks.

The Advisers Guiding Dimon

To guide this investment effort, Dimon has assembled what amounts to a national security supergroup. The advisory council includes some of the most influential leaders in business, government and the military.

From the business world, members include Jeff Bezos of Amazon, Michael Dell, Ford CEO Jim Farley, former Johnson and Johnson CEO Alex Gorsky and Phebe Novakovic of General Dynamics. Their backgrounds span everything from cloud computing to consumer technology to manufacturing and advanced defense hardware.

The political and diplomatic figures are equally prominent. The council includes former Secretary of State Condoleezza Rice, former Secretary of Defense Robert Gates and former Speaker of the House Paul Ryan.

The military members bring direct experience with national defense threats. They include Chris Cavoli, the former supreme allied commander for Europe, Ann Dunwoody, a retired Army general, and Paul Nakasone, who led the National Security Agency.

This group does not have formal decision making authority, but they will meet periodically to help Dimon and his team understand which industries and companies matter most. The council mirrors an international advisory board led by former British Prime Minister Tony Blair. It is designed to give JPMorgan a continuous view of global security needs.

Early Investments and the Race for Critical Minerals

JPMorgan’s first investment under the pledge was a seventy five million dollar purchase of a three percent stake in Perpetua Resources. The company is developing the only domestic source of antimony, a mineral used to harden ammunition and strengthen armor piercing rounds. The world’s dominant source of antimony is China, which produces about sixty percent of the global supply. China recently restricted its exports in response to U.S. trade measures, highlighting the risks of relying on foreign control for essential materials.

The pledge immediately triggered market reaction. Shares of rare earth and mineral companies surged after the announcement. USA Rare Earth rose thirty two percent, MP Materials climbed twenty four percent and Lithium Americas jumped eleven percent. Investors interpreted the pledge as confirmation that the United States is entering a critical minerals race and that private capital will flow aggressively into these industries.

The Dangers the Initiative Is Designed to Counter

Dimon’s warnings reflect a larger fear in policy circles that the United States has become too vulnerable to disruptions. China controls major parts of the supply chain for minerals, batteries, metals, semiconductors and key chemicals. Russia’s actions have exposed Europe’s energy weaknesses and shown how quickly nations can be destabilized when supplies collapse.

Dimon’s argument is that the United States must rebuild its domestic capacity now. He believes that only a strong America can maintain global stability. He said, “You need America to be very, very strong to secure global security. If America isn’t very strong, there’s no global security.”

The initiative also targets emerging technologies like artificial intelligence and autonomous systems, which are becoming central to both economic competition and military capability. Dimon predicts a surge in spending on drones, ships and advanced vehicles, and he wants JPMorgan positioned to support and profit from that shift.

Reactions have been noticeable across industries. Mineral and manufacturing companies are encouraged because they expect a wave of investment. Defense contractors see this as a sign that the private sector is aligning with government priorities. Analysts also note that the pledge aligns with President Trump’s push for reshoring and strengthening national capacity.

Some observers caution that Dimon has made large announcements before that did not reach their original goals. For example, JPMorgan’s two point five trillion dollar climate initiative and a high profile healthcare partnership with Bezos and Warren Buffett did not deliver the breakthroughs they promised. Still, supporters say the new pledge is different because the need for national security investment is immediate and widely recognized.

A New Era of Corporate Role in National Defense

Dimon’s initiative echoes the legacy of the early Morgan financiers who helped stabilize American industry in the Gilded Age. By building a council of major leaders and committing one point five trillion dollars, Dimon is positioning JPMorgan as a central player in a new era of national strategy.

Whether the pledge succeeds will become clear only over the next decade, but it signals a deep shift. America’s largest bank is preparing for a world where national strength depends on supply chain control, industrial capacity and technological leadership. Dimon and his advisers believe that building American resiliency is no longer optional. It is a requirement for preserving global security in a more dangerous age.

FAM Editor: Somehow I’m suspicious of the motive here. I’m thinking Diman has the idea to monopolized certain areas of defense that will prove to be profitable, and I’m thinking they will ignore the rest, despite any critical needs. This is presented as a patriotic mission, but in reality is it simple market analysis.