Americans are paying more than ever for hamburgers, steaks, and roasts, and industry experts say the high prices are not likely to fall anytime soon. A combination of shrinking cattle supplies, strong consumer demand, and structural changes in agriculture has pushed beef costs to record or near record levels. With the national herd now at its lowest point in generations, the forces driving prices upward could remain in place for years.

The Current Situation With Beef Prices

Beef prices have surged far faster than most other grocery items. Government data shows ground beef prices in January were up 17 percent compared with a year earlier, while overall grocery prices rose only 2.1 percent during the same period. Other data shows retail beef and veal prices increased about 15 percent over the past 12 months.

Economists say prices remain extremely elevated even when short term fluctuations occur. Texas A and M agricultural economist David Anderson explained that when comparing year over year data, “beef prices are double digit more than they were a year ago,” and overall “the level of beef prices continues to be essentially record high, just very high prices, but we’re producing less beef.”

Despite the higher costs, consumers continue buying beef. Demand has remained surprisingly resilient even as food inflation squeezes household budgets. One Kentucky shopper said, “I will pay extra for quality steaks, burgers,” reflecting a broader willingness among Americans to continue purchasing beef even at premium prices.

A Historic Collapse in the National Cattle Herd

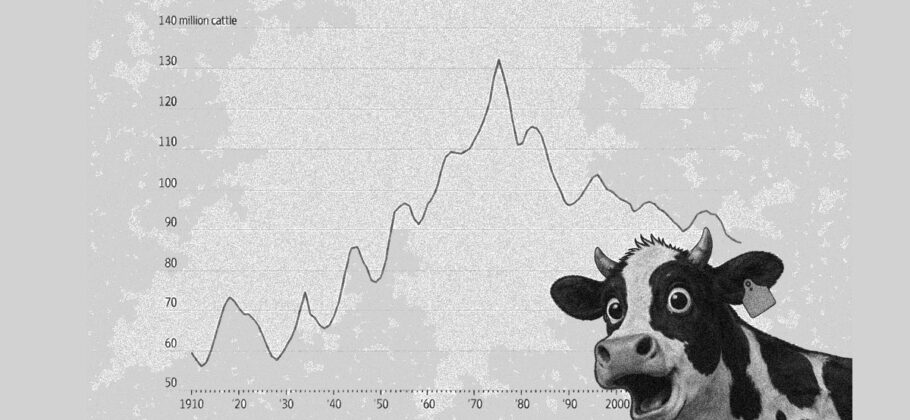

The most important factor driving prices is supply. The United States cattle herd has fallen to its lowest level in 75 years, according to the Agriculture Department. Federal inventory reports show fewer cows this year than last year, meaning herd expansion has not yet begun in a meaningful way.

The current herd size is dramatically lower than earlier decades when American cattle numbers were far higher. Industry officials also say the herd is unlikely to return to levels seen before 2020, even if rebuilding eventually begins.

With fewer cows producing fewer calves, the amount of beef available for slaughter has declined, tightening supply across grocery stores, restaurants, and the entire food system. Anderson explained the economic impact clearly, saying fewer cows mean “less beef production, and from a supply standpoint, some more pressure for higher prices in the future.”

Why Ranchers Reduced Herds

The decline in herd size developed over several years. Ranchers began shrinking herds during the Covid pandemic when financial conditions deteriorated. Severe drought across major cattle producing states such as Texas, Oklahoma, and Kansas also played a major role. Dry conditions destroyed grazing pastures and forced producers to buy expensive feed, which increased costs dramatically.

Higher feed costs remain a major issue. Although grain prices have eased somewhat from their peaks, they remain elevated compared with historical averages. Corn, a key component of cattle feed, has been affected by global supply disruptions, weather volatility, and strong export demand. Transportation, labor, and fuel costs have also increased, raising the overall cost of raising cattle.

Montana rancher Monty Lesh said drought conditions hurt his operation badly enough that he reduced his herd from 900 cattle to about 650. Even with prices now strong, he remains reluctant to rebuild because weather conditions remain uncertain and feed costs could surge again.

Financial caution is widespread across the industry. Many ranchers are using strong profits to repair equipment, pay down debt, and invest in herd genetics rather than expand herd size. Some producers are breeding cattle designed to produce higher quality meat that could command premium prices instead of simply increasing numbers.

Reluctance to Rebuild Herds

One of the most significant reasons prices may remain high is that ranchers are not rushing to expand production. Even though cattle prices are strong, rebuilding herds carries substantial risk.

Some ranchers worry about repeating the overproduction cycles seen in other agricultural sectors. Iowa rancher Mark Moore pointed to crop farming as a warning, saying, “Corn and soybean prices right now are suffering for a reason. We overproduced.”

Demographics also play a major role. The ranching population is aging rapidly. Federal data shows more farmers are over the age of 75 than under 35. For older ranchers without heirs to continue the business, expanding herd size may not make financial sense if they plan to retire or sell land.

Kansas rancher Philip Perry explained that herd expansion decisions depend heavily on succession planning. If producers do not have someone to take over the operation, they may choose stability over growth.

Strong Demand Keeps Prices Elevated

While supply has tightened, demand has remained strong. Americans continue to view beef as a premium protein, and many consumers are willing to pay more for quality.

Monty Lesh summarized the situation by saying, “Beef is the premium protein and consumer demand is reflecting that.”

Consumer preferences have also shifted toward higher quality grades over the past decade. Anderson noted growing demand for Prime and high Choice beef along with branded products such as Certified Angus Beef. He said consumers increasingly believe beef provides “value for the dollar,” which helps sustain demand even when prices rise relative to pork and chicken.

Even when consumers adjust spending, they often stay within the beef category rather than abandoning it. Shoppers may choose less expensive cuts, thinner steaks, or different packaging sizes to manage costs while continuing to buy beef.

Restaurants Are Feeling the Pressure

Restaurants are facing rising costs across the board, especially chains that rely heavily on beef. Burger chains such as Burger King, Wendy’s, and Jack in the Box have all warned investors that beef inflation could hurt profits.

Steakhouses are also dealing with the challenge. Texas Roadhouse, where more than 50 percent of menu items involve beef, reported that historically high beef prices reduced restaurant margins. Restaurant margin fell 309 basis points to 13.9 percent, partly due to commodity inflation of 9.5 percent.

The company plans to raise menu prices by about 1.9 percent to offset higher costs. Chief executive Jerry Morgan said the company is trying to balance customer expectations with financial realities, explaining, “We continue to try to be very conservative. We look at it from the lens of our guests and our business and our shareholders and try to find a solid balance.”

He also acknowledged the ongoing pressure directly, saying, “We also know beef is a challenge, and we will continue to look at it.”

Despite rising prices, Texas Roadhouse continues to see strong demand. The company generated nearly 5.8 billion dollars in revenue in 2025, and more than 70 percent of locations set sales records, showing that consumers are still willing to spend on beef meals even as prices rise.

Meatpacking Industry Signals Long Term Shortages

Meatpacking companies are preparing for continued tight supply rather than a quick rebound. Tyson Foods closed one of the largest beef plants in the United States in Nebraska, laying off about 3,200 workers. The company also cut production in half at another major Texas facility.

Competitors JBS and Cargill have also closed smaller facilities that process beef products for restaurants and grocery stores.

Tyson executives told analysts that available data points to “an ultimately smaller herd,” indicating that industry leaders expect reduced supply for the foreseeable future.

Why High Prices May Persist for Years

Even if ranchers decide to expand production, biological constraints make rapid recovery impossible. A heifer kept for breeding will not produce a market ready calf for about two years. Analysts estimate meaningful herd growth may not occur until 2028 at the earliest.

This slow biological cycle means that shortages today can affect prices for several years into the future.

Imports may help somewhat, but global supply faces its own challenges, including weather disruptions and trade uncertainties. The United States is already importing record amounts of beef, particularly lean trimmings from Australia, New Zealand, Brazil, and Argentina, to support ground beef production because domestic cow herds are so small.

Policies Affecting the Market

Government officials have attempted to address rising prices through policy measures. The Trump administration has taken steps to increase imports by quadrupling beef imports from Argentina and reducing some tariffs on Brazilian beef, although the overall volume remains relatively small compared with domestic production.

At the same time, federal dietary guidelines now encourage Americans to consume more protein and place beef prominently in recommendations. At an industry event, Health Secretary Robert F. Kennedy Jr. said he eats beef twice a day and urged ranchers to increase herd sizes to ease supply pressure.

Some policymakers have proposed tax credits to encourage ranchers to retain cattle for breeding rather than send them to slaughter. However, producers remain skeptical that government incentives will significantly change decisions. One rancher said financial incentives might encourage participation, but “it doesn’t mean that they’ll increase their cow numbers.”

The Outlook for Consumers

The overall message from economists, ranchers, meatpackers, and restaurants is consistent. Supply is tight, demand remains strong, and producers are cautious about expansion. These forces point toward sustained high prices rather than a quick decline.

For consumers, that means beef may remain expensive for the foreseeable future. Economists suggest shoppers who want to manage costs may need to choose less expensive cuts, buy in bulk when possible, or substitute other proteins more frequently.

But for many Americans, beef remains a staple worth paying for, even at record prices.