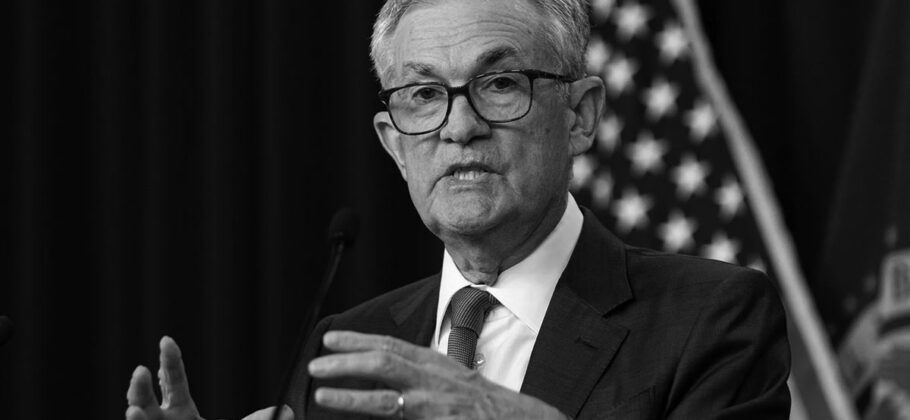

Federal Reserve Chair Jerome Powell delivered one of his most serious economic warnings yet on Wednesday, telling business leaders in Chicago that President Donald Trump’s aggressive tariff policy could lead the U.S. into a highly unstable economic situation. Speaking at the Economic Club of Chicago, Powell said the sweeping changes in trade policy are unlike anything the Federal Reserve has faced in modern times, and the potential consequences could include slower growth, rising unemployment, and persistent inflation all at once.

Who is Jerome Powell and Why Does This Matter?

Jerome Powell is the Chairman of the Federal Reserve, the most powerful economic policymaker in the United States after the President. The Federal Reserve sets interest rates and manages the money supply with two goals assigned by Congress: to maintain stable prices and to support maximum employment.

Powell’s comments came just two weeks after Trump announced a new wave of import taxes on goods from countries including China, Mexico, and Canada, with tariffs as high as 145 percent in some cases. Powell said these actions are creating a level of economic uncertainty that is difficult to manage. “These are very fundamental policy changes,” Powell explained. “There isn’t a modern experience of how to think about this.”

What Did Powell Say That Was Alarming?

The heart of Powell’s message was that the scale of Trump’s tariffs is much larger than expected and that the economic fallout could be worse than anything the Federal Reserve has faced in decades. “The level of the tariff increases announced so far is significantly larger than anticipated,” Powell said, adding that “the same is likely to be true of the economic effects, which will include higher inflation and slower growth.”

He warned that the country may be entering a rare and dangerous situation where both of the Fed’s goals are under threat at the same time. “We may find ourselves in the challenging scenario in which our dual-mandate goals are in tension,” Powell said. “If that were to occur, we would consider how far the economy is from each goal, and the potentially different time horizons over which those respective gaps would be anticipated to close.”

This kind of conflict between rising inflation and rising unemployment is known as “stagflation,” a condition the U.S. hasn’t seen since the 1970s. Powell pointed out that the current situation could become worse than that. “The Smoot-Hawley tariffs were actually not this large and they were 95 years ago,” he said. “So there isn’t a modern experience of how to think about this.”

How Are the Markets and Other Officials Responding?

Wall Street responded swiftly to Powell’s speech. As he spoke, the Dow Jones Industrial Average fell by more than 700 points. The S&P 500 dropped 2.5 percent, and the Nasdaq slid 3.5 percent. Investors were clearly rattled by the idea that the Federal Reserve might not be able to control the economy under the weight of Trump’s tariffs.

David Russell, head of market strategy at TradeStation, said, “Jerome Powell just laid down the law with Trump. It was a clear warning about stagflation, and a declaration that the Fed won’t enable the White House with rate cuts.”

Other top Federal Reserve officials also voiced concerns. Cleveland Fed President Beth Hammack said on Wednesday, “This is a difficult set of risks for monetary policy to navigate.” She added that the Fed should hold interest rates steady for now to see how the economy reacts. Chicago Fed President Austan Goolsbee described Trump’s tariffs as a “stagflationary shock,” meaning they are likely to increase prices while slowing job growth. “There is not a generic playbook for how the central bank should respond to a stagflationary shock,” he said.

How Will Tariffs Affect the Public?

One of the most direct parts of Powell’s message was aimed at everyday Americans. Despite Trump’s claims that foreign countries are paying the tariffs, Powell made it clear that American consumers will shoulder much of the cost. “Unemployment is likely to go up as the economy slows,” he said, and “inflation is likely to go up as well.” That means people will likely lose jobs while prices go up at the same time.

Powell stressed that “a portion of the burden of tariffs is going to be paid by the public.” He added that the longer tariffs stay in place, the more likely it is that these price increases will become permanent. “Tariffs are highly likely to generate at least a temporary rise in inflation,” he said. But he also warned that “the effects could also be more persistent.”

What Will the Fed Do Next?

Powell said that for now, the best strategy is to wait and watch. “For the time being, we are well positioned to wait for greater clarity before considering any adjustments to our policy stance,” he explained. This means the Fed is not planning to raise or lower interest rates until it has more evidence of how the economy is reacting.

He added that if inflation expectations become unanchored — meaning if people begin to expect higher prices for years to come — then the Fed may be forced to act. “Our obligation is to keep longer-term inflation expectations well anchored,” Powell said, “and to make certain that a one-time increase in the price level does not become an ongoing inflation problem.”

Still, the Fed’s current position is cautious. Inflation remains slightly above the Fed’s 2 percent target, and unemployment is still low. However, Powell said recent consumer and business surveys show rising concern about the future. Business activity in New York and New Jersey, for example, just fell to its lowest level in over a year.

The path forward is full of uncertainty. Powell and his team at the Federal Reserve are facing one of the most complex policy environments in decades. The economy has not yet slipped into stagflation, but the risk is growing.

Some economists, like Fed Governor Christopher Waller, argue that the inflationary effect of tariffs might be temporary. Waller said earlier this week that tariffs could raise prices for a while but eventually cool down the economy so much that inflation would drop again. He predicted inflation could spike to 4 percent before slowing as unemployment climbs to 5 percent.

But Powell appeared less confident in that view. He warned that damage to supply chains, particularly in the auto industry, could last for years. “You would worry that that process will take some years, and that the inflationary process might be extended,” he said.

Even as Powell stressed that the economy is still in a “solid position,” he acknowledged that Trump’s tariff strategy had created a storm of uncertainty. “Looking forward,” he said, “the new administration is in the process of implementing substantial policy changes. Those policies are still evolving, and their effects on the economy remain highly uncertain.”

FAM Editor: Remember that Powell is not exactly a friend of the Trump Administration. A warning is to be expected as Powell and company cover their rears, which they will do even if it upsets the markets.

We believe the dip in the market is an buy opportunity.